Tax Identity Theft Week is a week-long event dedicated to raising awareness about tax-related identity theft and providing resources to prevent and mitigate this growing problem. Introducing Tax Identity Theft Week, a comprehensive and impactful event aimed at combatting the rising issue of tax-related identity theft.

This annual event not only educates individuals on the risks and consequences associated with this crime but also offers practical solutions to protect against it. With tax season in full swing, it’s essential to stay vigilant and take proactive measures to safeguard personal information.

This informative and empowering week offers workshops, seminars, and guidance from experts to ensure individuals are equipped with the tools and knowledge needed to prevent tax identity theft. Don’t let your financial security be compromised; join Tax Identity Theft Week and safeguard your personal and financial well-being.

Understanding Tax Identity Theft

Tax identity theft occurs when someone uses your personal information, such as your Social Security number, to file a fraudulent tax return and claim a refund. This can happen without your knowledge and can lead to multiple problems.

| Method | Description |

|---|---|

| Phishing | Fraudsters send deceptive emails, posing as legitimate entities, to trick taxpayers into sharing confidential information. |

| Stolen Documents | Thieves acquire sensitive data directly from individuals or businesses by stealing unattended personal documents. |

| Data Breaches | Criminals exploit security vulnerabilities to gain unauthorized access to databases and steal personal information on a large scale. |

Once your identity is stolen for tax purposes, the consequences can be severe. It may take months to resolve the issue, leading to delays in receiving any legitimate tax refunds. You may also face potential audits, disputes with the IRS, and damage to your credit score. It is crucial to stay vigilant and take proactive measures to protect your personal information.

Preparing For Tax Season Safely

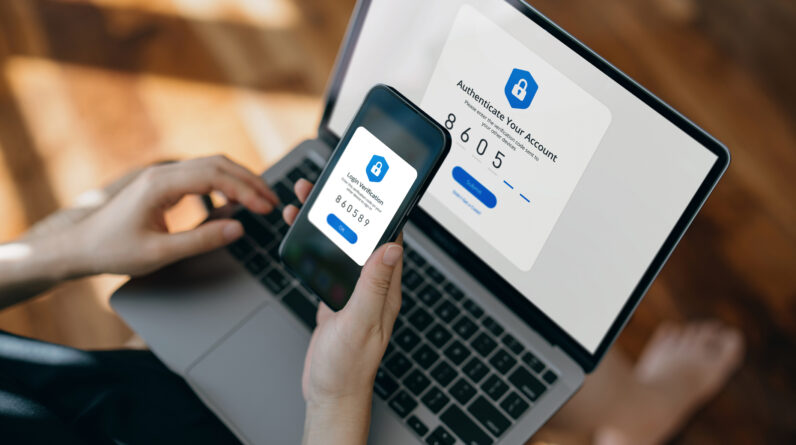

In order to prepare for tax season safely, it is crucial to prioritize the secure storage of personal documents. Sensitive information such as social security numbers, tax forms, and financial records should be kept in a locked and fireproof safe or a secure digital storage system. When it comes to safeguarding sensitive information online, it is important to be vigilant. Install antivirus software and keep it up to date to protect against malware and phishing attempts. Additionally, employing strong and unique passwords for all online accounts is essential. Avoid using common and easily guessable passwords such as birthdays or sequential numbers. Instead, use a combination of letters, numbers, and symbols to create strong passwords that hackers cannot easily crack. By following these precautions, you can minimize the risk of tax identity theft and ensure a safe tax season.

Detecting And Reporting Tax Identity Theft

Tax identity theft is a serious issue that can have significant financial consequences if not detected and reported. Recognizing the signs of tax identity theft is the first step towards protecting yourself. Look out for unusual or unexpected communications from the IRS, such as receiving a notice stating additional income or a tax return already filed in your name. If you suspect tax identity theft, it’s important to take immediate action. Start by contacting the IRS Identity Protection Specialized Unit and filing an Identity Theft Affidavit. Next, place a fraud alert with the three major credit bureaus, Equifax, Experian, and TransUnion. Monitor your credit reports regularly for any unauthorized activity. If you discover fraudulent tax returns, report them to the IRS and your local law enforcement agency. Remember, quick action is crucial in preventing further damage and recovering your identity.

How To Prevent Tax Identity Theft

Tax identity theft is a prevalent crime that can cause significant financial and emotional distress. Fortunately, there are steps you can take to prevent becoming a victim. One way to safeguard your information is by filing taxes early. By submitting your tax return promptly, you reduce the window of opportunity for identity thieves. Moreover, utilizing secure online filing services can also provide added protection. These services often implement advanced security measures to ensure the confidentiality of your data. Additionally, it is essential to keep an eye on your credit report. Regularly monitoring your credit report allows you to detect any suspicious activity or unauthorized accounts. By taking these precautions, you can reduce the risk of tax identity theft and protect your financial well-being.

Other Identity Theft Prevention Tips

Protecting personal information offline:

One of the key ways to prevent tax identity theft is by protecting personal information offline. Here are some tips:

- Be cautious with your documents: Keep important documents, such as your Social Security card or tax forms, in a secure place, preferably locked.

- Shred sensitive documents: Before discarding any documents that contain personal information, make sure to shred them to prevent identity theft.

- Be mindful of sharing information: Avoid sharing personal information, such as your Social Security number or bank account details, unnecessarily.

- Don’t fall for scams: Be vigilant of phishing scams and social engineering tactics that may trick you into revealing personal information.

- Use reputable tax preparation services: When choosing a tax preparation service, opt for a reputable one to ensure the security of your personal information.

By implementing these offline security measures, you can significantly reduce the risk of tax identity theft.

Resources For Victims Of Tax Identity Theft

Contacting The Irs

Tax identity theft can be a distressing experience, but there are resources available to help you navigate the situation. One important step is to contact the Internal Revenue Service (IRS) as soon as you become aware of the theft. The IRS has a dedicated Identity Protection Specialized Unit that can provide guidance and support. They can assist you in reporting the theft, confirming your identity, and providing information on how to proceed.

Seeking Legal Assistance

If you find yourself overwhelmed or unsure of how to handle tax identity theft, it may be beneficial to seek legal assistance. An attorney experienced in identity theft cases can provide valuable advice and representation throughout the process. They can help you understand your rights, communicate with the IRS on your behalf, and take legal action if necessary.

Steps To Restore Your Identity And Credit

Restoring your identity and credit is crucial after falling victim to tax identity theft. Take the following steps to begin the recovery process:

- File a report with your local law enforcement agency to document the theft and protect yourself from any potential legal repercussions.

- Contact the credit bureaus and place a fraud alert on your credit reports. This can help prevent further unauthorized activity and alert you to potential fraudulent accounts.

- Notify your financial institutions, including banks and credit card companies, of the theft. They can monitor your accounts for suspicious activity and help you secure your finances.

- Keep detailed records of all conversations and correspondence related to the theft, including dates, times, and the names of individuals you speak with.

- Work with the IRS to rectify any fraudulent tax filings and request an Identity Protection PIN to protect your future tax returns.

Credit: www.kgw.com

Frequently Asked Questions On Tax Identity Theft Week

Can Identity Theft Affect My Tax Refund?

Yes, identity theft can impact your tax refund.

How Many Identity Theft Victims In 2023?

There is no specific data available for the number of identity theft victims in 2023 at this time.

How Much Money Was Lost Last Year Due To Identity Theft?

Last year, identity theft resulted in significant financial losses. The exact amount lost is not provided, but it was a substantial sum of money.

Does The Irs Notify You Of Identity Theft?

Yes, the IRS will notify you if they suspect identity theft, helping you take appropriate action.

Conclusion

Tax Identity Theft Week serves as a wake-up call for individuals to protect themselves against the growing threat of identity theft. By staying vigilant, keeping personal information secure, and being aware of common scams, we can minimize the risk and safeguard our finances.

Stay informed, take preventive measures, and empower yourself in the fight against tax identity theft.