Portfolio Recovery may call from different numbers to increase the chances of reaching the debtor and encourage payment. They use this tactic to avoid being easily identified or blocked by recipients.

The Frequency Of Portfolio Recovery Calls: What You Should Know

The Frequency of Portfolio Recovery Calls: What You Should Know

Portfolio Recovery is known for frequently contacting individuals who owe debts. A common question many people have is why the company keeps calling from different numbers. The answer lies in their collection strategy. By using multiple phone numbers, they attempt to increase the likelihood of getting a response from the debtor.

So how often can you expect these calls? Portfolio Recovery is persistent in their efforts and may contact you several times a week or even daily. Receiving such regular calls can have a considerable impact on you. It can cause stress and anxiety, disrupting your daily life and productivity. It is essential to understand your rights and options when dealing with Portfolio Recovery.

Remember, if you are being contacted by Portfolio Recovery or any other debt collector, it is crucial to stay informed and protect yourself. Ensure you are aware of your rights under the Fair Debt Collection Practices Act (FDCPA) and consider seeking legal advice if the calls become overwhelming or harassing in nature.

The Reasons Behind Portfolio Recovery’s Use Of Different Numbers

Why Does Portfolio Recovery Keep Calling from Different Numbers

The Reasons Behind Portfolio Recovery’s Use of Different Numbers

The Benefits and Strategies of Using Multiple Phone Numbers

Debt collectors, such as Portfolio Recovery, often change their caller ID information for several reasons. One of the main benefits of using different numbers is to increase the likelihood of getting in touch with the debtor. By using multiple phone numbers, debt collectors can make it appear as if the call is coming from a local or familiar area code, increasing the chances that the call will be answered. Additionally, caller ID spoofing is another strategy often employed by debt collectors. This technique allows them to manipulate the caller ID to display a different phone number than the one they are actually calling from.

The use of different numbers and caller ID spoofing can have a significant impact on debt collection calls. It can make it more difficult for debtors to identify and block unwanted calls. Moreover, it can create confusion and make it challenging for debtors to keep track of all the different numbers being used by debt collectors. Overall, these tactics aim to improve the chances of successfully contacting debtors and recovering outstanding debts.

Dealing With Portfolio Recovery Calls: Tips And Guidelines

| Dealing with Portfolio Recovery Calls: Tips and Guidelines |

| Effective Ways to Handle Frequent Calls from Portfolio Recovery |

If you are receiving frequent calls from Portfolio Recovery and wondering why they keep using different numbers, it is essential to understand your rights as a consumer when dealing with debt collectors. Portfolio Recovery is a debt collection agency that may contact you in an attempt to recover outstanding debts. However, there are guidelines and steps that you can take to handle these calls effectively.

Firstly, familiarize yourself with your rights under the Fair Debt Collection Practices Act (FDCPA). This act outlines the fair and legal ways in which debt collectors can communicate with you. If you believe that Portfolio Recovery has violated any of these rights, it is important to take action. Document the calls, gather evidence, and consider reaching out to a consumer protection attorney for guidance.

Remember to remain calm during these interactions and avoid disclosing any personal or financial information over the phone. Portfolio Recovery is required to validate the debt they are attempting to collect, so you can request proper documentation to verify the legitimacy of the claim.

Understanding Debt Validation And Its Importance

Debt validation plays a crucial role in handling the persistent calls from Portfolio Recovery. So, what exactly is debt validation and why is it important? Debt validation is a process where consumers request proof from the debt collector to validate the accuracy and legitimacy of the debt. This is especially important when dealing with companies like Portfolio Recovery, as they often use different phone numbers to contact consumers.

By requesting debt validation, you are exercising your rights as a consumer to ensure the debt is indeed legitimate and that you are not being harassed by scam callers. When you receive a call from Portfolio Recovery or any other debt collector, you can request validation of the debt in writing within 30 days. Once the collector receives your request, they must cease all collection efforts until they provide the requested validation.

Understanding the process of requesting debt validation from Portfolio Recovery is important. You need to send a written letter requesting validation, including your name, account number, and the specific debt you are seeking validation for. It’s essential to send the letter via certified mail with a return receipt requested to have proof of delivery and ensure your request is properly documented.

Negotiating A Settlement With Portfolio Recovery

Understanding the Debt Settlement Process and Its Benefits

When dealing with debt, it’s important to know the options available to you. One potential solution is negotiating a settlement with Portfolio Recovery. In this process, you can work with the creditor to establish a payment plan that is mutually beneficial.

Steps to Negotiate a Settlement with Portfolio Recovery:

- Gather necessary documentation: Ensure you have all the relevant information regarding your debt, including account numbers, balances, and payment history.

- Assess your financial situation: Evaluate your current income and expenditure to determine how much you can realistically offer as a settlement.

- Contact Portfolio Recovery: Initiate a conversation with Portfolio Recovery to express your willingness to negotiate a settlement. Be prepared to explain your situation and present your proposed settlement amount.

- Negotiate and reach an agreement: Engage in open and honest discussions with Portfolio Recovery to find a settlement amount that both parties can agree upon. Consider seeking professional assistance if needed.

- Get the agreement in writing: Once an agreement is reached, ensure that you receive written confirmation outlining the terms of the settlement. It’s essential to keep a copy for your records.

Tips for Successful Debt Settlement Negotiations:

- Stay calm and composed: Be respectful and professional during the negotiation process.

- Clearly communicate your financial limitations while expressing your commitment to resolving the debt.

- Be persistent and patient: Negotiations may take time, so it’s important to stay focused and continue working towards a resolution.

- Consider seeking professional help: Debt settlement companies or credit counseling agencies can provide expertise and guidance throughout the negotiation process.

- Follow through on agreed-upon payments: Once a settlement is reached, ensure that you fulfill your end of the agreement by making payments as agreed upon.

Protecting Yourself From Unwanted Portfolio Recovery Calls

Are you tired of receiving unwanted calls from Portfolio Recovery that seem to come from different numbers? It can be frustrating and intrusive, but fortunately, there are steps you can take to protect yourself and minimize these calls.

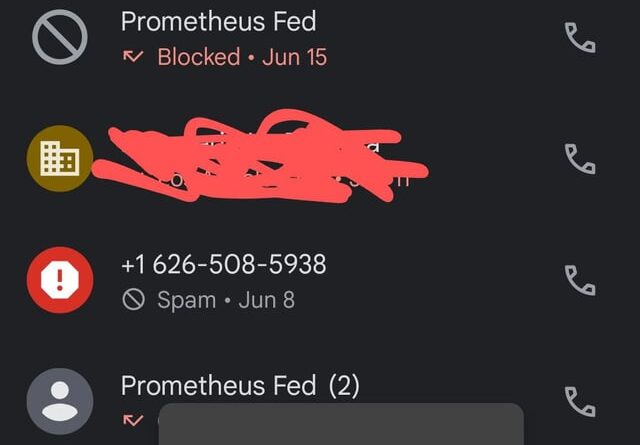

One option you have is to block Portfolio Recovery numbers. This can typically be done through your phone settings or by using call-blocking apps. By blocking these numbers, you can prevent them from reaching your phone.

Another measure you can take is to opt out of Portfolio Recovery calls. You can do this by contacting Portfolio Recovery directly and requesting to be removed from their call list. Be sure to provide your name, phone number, and any other relevant information so they can locate and remove your contact information.

In addition to blocking and opting out, there are other steps you can take to minimize Portfolio Recovery calls. For example, you can register your phone number on the National Do Not Call Registry, which helps reduce unwanted telemarketing calls. Additionally, you can report any persistent or abusive calls to your local authorities or the Federal Trade Commission.

By taking these precautions and being proactive, you can protect yourself from unwanted Portfolio Recovery calls. Remember to regularly review and update your call-blocking settings as new numbers may emerge.

Seeking Professional Help And Legal Advice

If you are constantly receiving calls from Portfolio Recovery from different numbers, it might be a good idea to seek professional help and legal advice. Professional help can provide valuable guidance and assistance in dealing with debt collectors and protecting your rights. So, when should you consider seeking professional help? It is advisable to reach out to a professional if you are facing harassing or abusive phone calls, or if you are unsure about your legal rights in regards to debt collection. Choosing the right debt relief agency or attorney is crucial. Look for professionals experienced in debt collection laws and regulations. They can help you navigate through the complexities of debt collection, negotiate with creditors on your behalf, and potentially even represent you in legal proceedings if necessary. Understanding your legal rights and protections against debt collectors is also essential. Legal advice can shed light on the Fair Debt Collection Practices Act (FDCPA) and other relevant laws that protect consumers from unfair and deceptive debt collection practices.

Remember, it is important to take action when faced with persistent calls from Portfolio Recovery. Seeking professional help and legal advice can provide you with the knowledge and support needed to effectively address the situation and protect your rights as a consumer.

| When Should You Consider Seeking Professional Help? | If you are facing harassing or abusive phone calls, or if you are unsure about your legal rights in regards to debt collection. |

| Choosing the Right Debt Relief Agency or Attorney | Look for professionals experienced in debt collection laws and regulations who can navigate through the complexities of debt collection, negotiate with creditors, and represent you in legal proceedings if necessary. |

| Understanding Legal Rights and Protections Against Debt Collectors | Gain a comprehensive understanding of the Fair Debt Collection Practices Act (FDCPA) and other laws that safeguard consumers from unfair and deceptive debt collection practices. |

Credit: www.bankrate.com

Frequently Asked Questions Of Why Does Portfolio Recovery Keep Calling From Different Numbers

Why Does Portfolio Recovery Keep Calling Me?

Portfolio Recovery may be calling you because they believe you owe a debt. They may also be calling you by mistake or as part of a debt collection strategy. It’s important to verify your debt and understand your rights under the Fair Debt Collection Practices Act (FDCPA) if you receive calls from Portfolio Recovery or any other debt collector.

How Do I Stop Portfolio Recovery From Calling?

To stop Portfolio Recovery from calling, you can send them a cease and desist letter asking them to stop all communication. Make sure to send the letter via certified mail with a return receipt, and keep a copy for your records.

If they continue to call you after receiving the letter, they may be in violation of the law.

What Should I Do If Portfolio Recovery Calls Me From Different Numbers?

If Portfolio Recovery calls you from different numbers, it could be a tactic they use to get around call blocking or to make it more difficult for you to track their calls. Keep a record of each call, including the date, time, and number they called from.

You can file a complaint with the Consumer Financial Protection Bureau (CFPB) and your state’s attorney general’s office if they continue to call you.

Conclusion

The persistent calls from Portfolio Recovery may leave you wondering why they’re using different numbers. These frequent calls can be frustrating and concerning, leading many to question their legitimacy. Understanding the reasons behind this strategy can help you navigate the situation better.

Whether it’s a tactic to increase the chances of reaching you or an attempt to mask their identity, being aware of these possibilities can empower you to handle their calls more effectively.